Creating Leverage

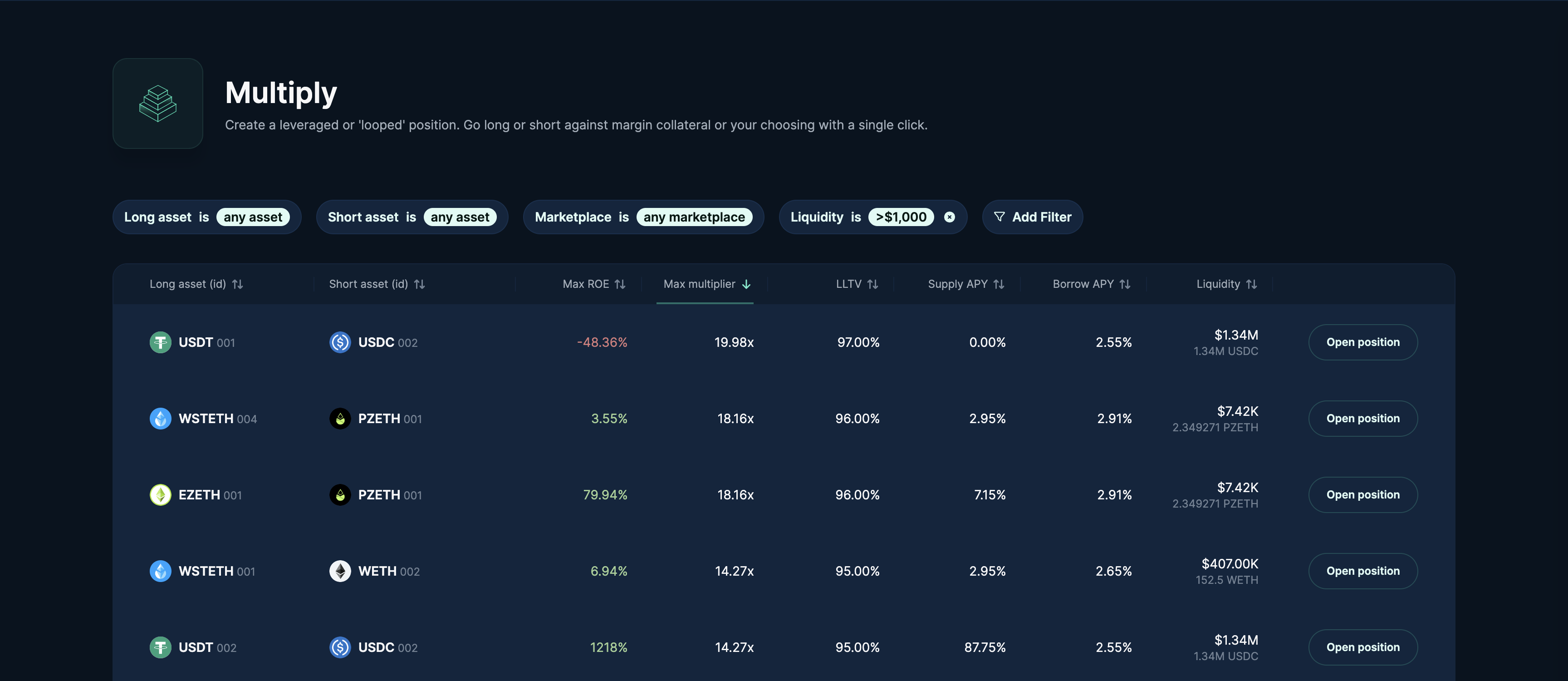

The Multiply Page shows all opportunities to create leveraged positions on Euler.

Link: app.euler.finance/multiply

A leveraged position consists of 4 actions: supplying assets as collateral, borrowing against them, swapping that back to the collateral asset and supplying it again as collateral.

Choosing a Pair

Similar to the Borrow Page the Multiply Page shows pairs of markets.

Pair Details

- Long Market: The asset deposited as collateral.

- Short Market: The asset borrowed against the collateral.

- Max ROE: The net annual precentage yield you can earn with a position at maximum leverage.

- Max Multiplier: The maximum leverage multiplier

- Supply APY: The annual precentage yield you earn for supplying collateral.

- Borrow APY: The annual precentage yield you pay for borrowing. This value may be negative if there are rewards on the market, in which case you are being paid to borrow.

- Liquidity: The available assets to borrow from the Short market.

Each market has an accompanying numeric ID which uniquely identifies the market among all markets for that asset.

Each APY value is inclusive of intrinsic yield (e.g. staking yield) and available rewards campaigns. Hover over the value for a breakdown.

Once you select a pair you can click on its row to go to its dedicated pair page. This page lists all parameters of the pair in more details.

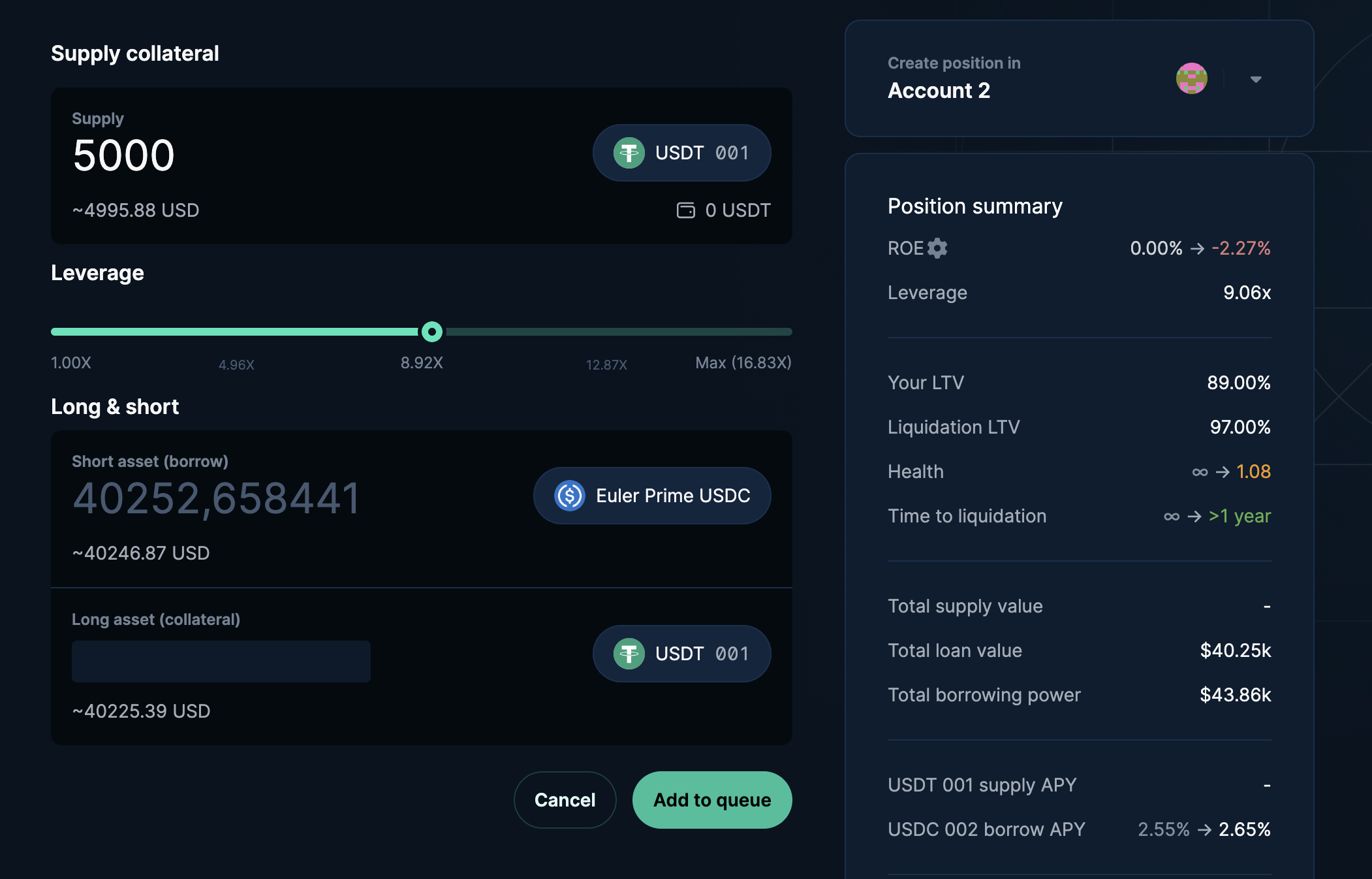

Creating a Leveraged Position

To open the position on your selected pair press the Multiply button on the right of the row.

You will be taken to a form where you can enter the amount and complete your transaction.