Markets

Introduction

A market on Euler is a marketplace where borrowers obtain loans and lenders provide capital (in the form of crypto assets) in exchange for interest. On Euler, builders can create custom markets by deploying vaults with the Euler Vault Kit (EVK) and linking them using the Ethereum Vault Connector (EVC).

The configuration of vaults determines the structure of the market, balancing capital efficiency and risk in different ways depending on the design. Euler's modular architecture allows market creators to design various forms of markets, from simple isolated collateral-debt pairs to more complex, capital-efficient, cross-collateralised clusters.

Market designs

Euler is the only lending protocol that makes vaults a core primitive, enabling builders to create tailor-made markets for diverse use cases in a permissionless manner. With the EVK and EVC, developers can replicate markets similar to those on Morpho, FraxLend, Kashi, Silo, Compound, or Aave. Euler's unparalleled modularity offer unique flexibility, allowing builders to deploy vaults that accept collateral from existing vaults in any other market. This fosters greater composability, accelerates ecosystem growth, and drives innovation within Euler.

Simple collateral-debt pairs

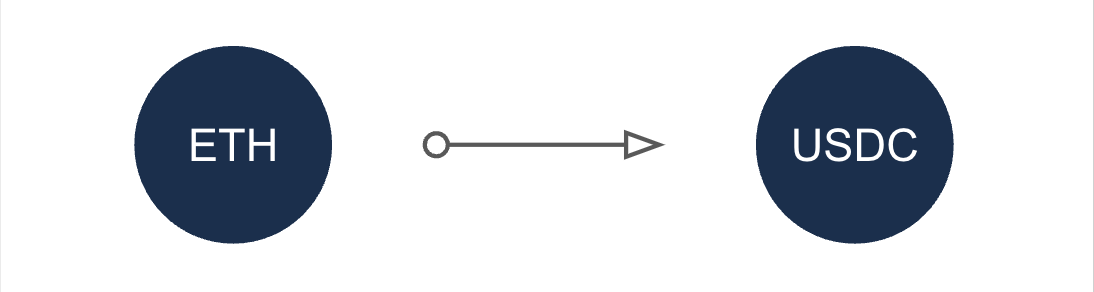

As shown in Figure 1, the most basic market on Euler requires a builder to specify at least two vaults:

- Vault A lends assets out.

- Vault B holds assets in escrow as collateral to borrow from Vault A.

It can get no simpler than this. This design helps isolate risk within the simple market, but suffers from capital inefficiencies and liquidity fragmentation.

Figure 1: An example of a simple collateral-debt pair. A USDC vault lends assets, and a ETH vault holds ETH collateral in escrow to borrow from the USDC vault. This setup mirrors markets found in protocols like Morpho, FraxLend, and Kashi.

Collateral-debt pairs with rehypothecation

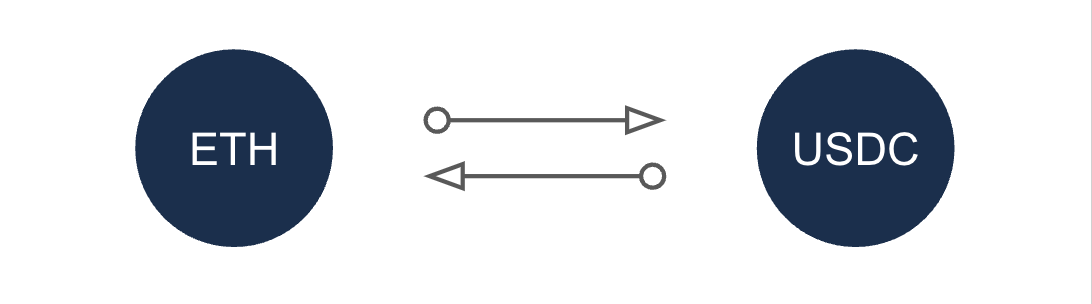

A more advanced market allows assets in Vault A to serve as collateral to borrow from Vault B, while assets in Vault B act as collateral to borrow from Vault A. See Figure 2. This rehypothecation mechanism enhances capital efficiency:

- Collateralised assets are not idle; they generate yield while backing loans.

- Borrowers can reduce net borrowing costs.

- More capital-efficient borrowing across pairs is enabled.

This design also unlocks more borrowing opportunities. If Vault A can borrow from Vault B, and Vault B can borrow from Vault C, then Vault A can indirectly borrow from Vault C via Vault B.

Figure 2: An example of a simple market. An ETH vault serves as collateral to borrow from a USDC vault, and the same USDC vault can act as collateral to borrow from the ETH vault. This structure enhances capital efficiency by allowing assets to be simultaneously used for lending and borrowing. This model is similar to markets on Silo and Fluid.

Markets with multiple collaterals

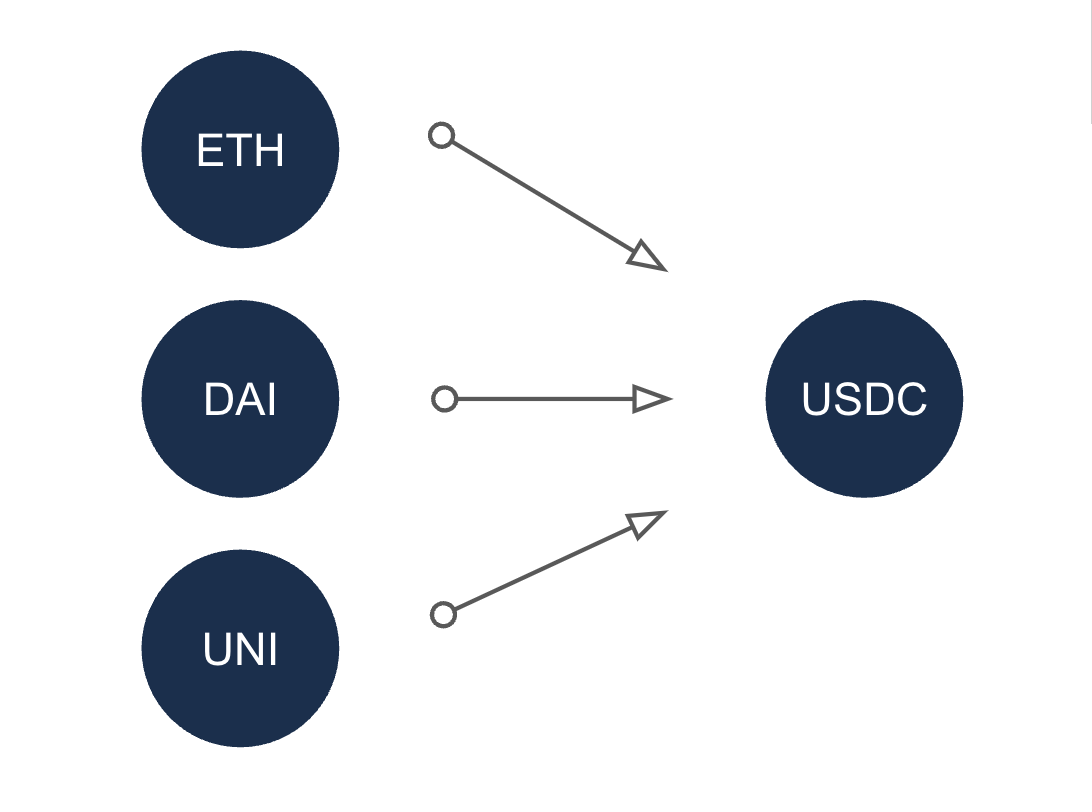

To improve capital efficiency further, a market can allow multiple assets as collateral for borrowing. See Figure 3. Increased borrowing options:

- Drive up interest rates for lenders.

- Reduce liquidity fragmentation by allowing more borrowing paths.

For example, if Vault A is borrowable by Vaults B, C, D, and E, it consolidates liquidity. The alternative—splitting liquidity across separate pairs (A-B, A-C, A-D, A-E)—can fragment liquidity, making borrowing harder and interest rates more volatile. While fragmentation can serve as a risk management tool, it can also create inefficiencies for borrowers.

Figure 3: An example of a market where multiple vaults are used as collateral. ETH, DAI and UNI collateral vaults are used to borrow from a single USDC lending vault, reducing fragmentation and improving borrowing efficiency. This model is similar to markets on Compound.

Cross-collateralised markets

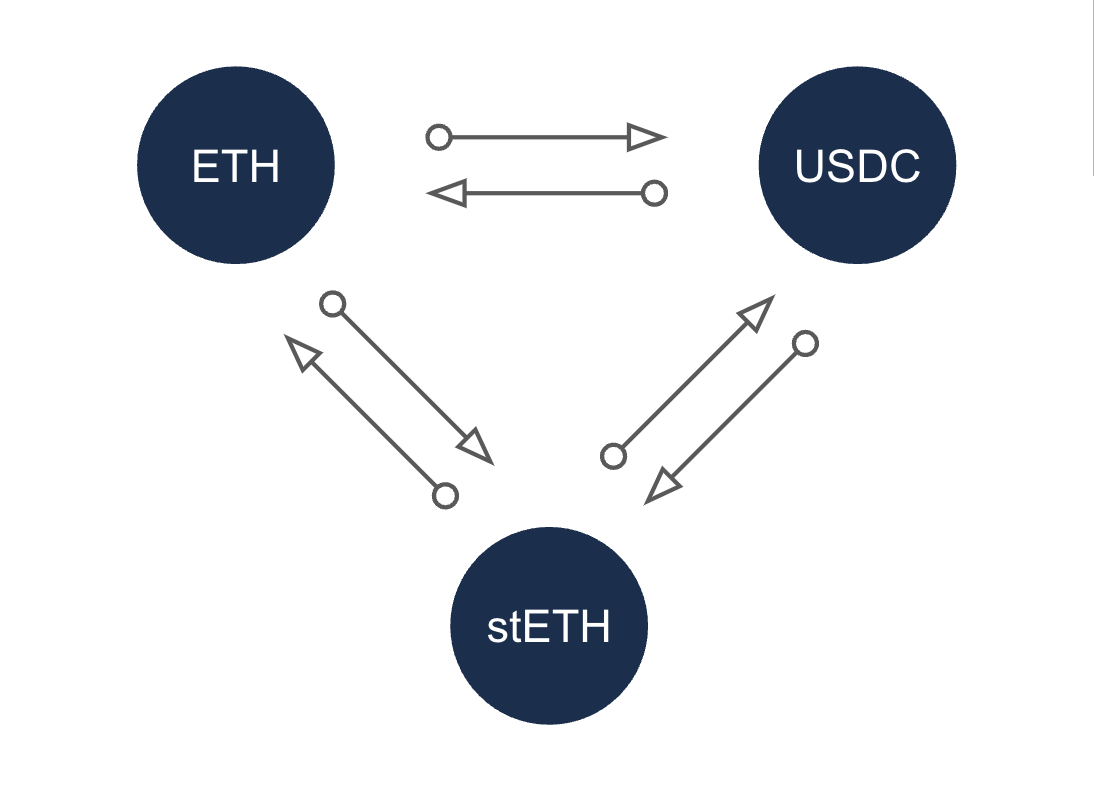

The most capital-efficient markets involve cross-collateralised clusters of multiple vaults. See Figure 4. Here:

- Each vault can lend assets while serving as collateral.

- Benefits include rehypothecation, higher borrowing demand, and reduced liquidity fragmentation.

However, these setups introduce higher contagion risk—if one vault defaults, risk spreads across the system.

Figure 4: A system where multiple vaults both lend assets and act as collateral. ETH, stETH, and USDC vaults can all be used to lend and borrow against one another, enabling higher capital efficiency. This model resembles a simpler version of the way markets work on Aave.

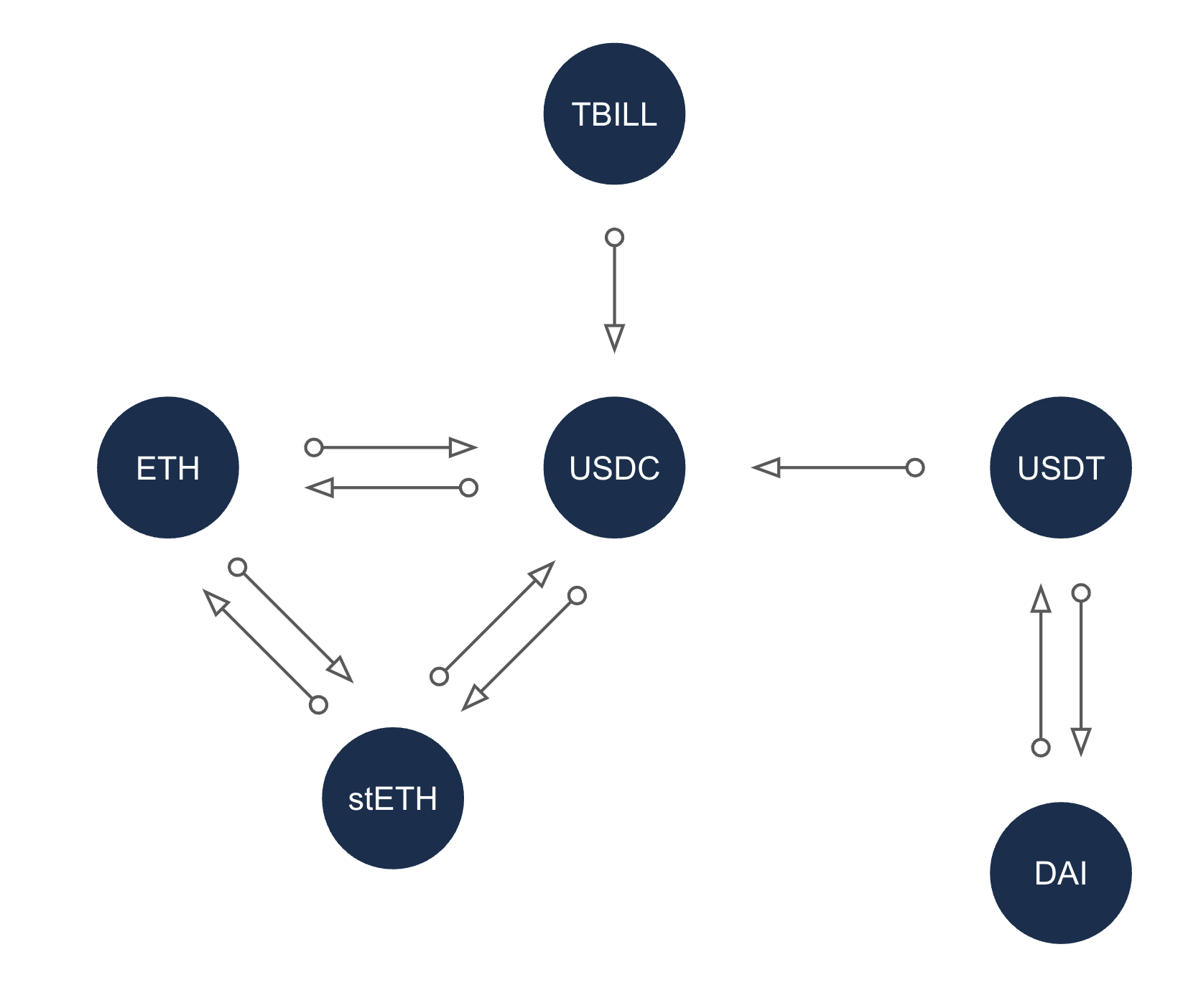

Fully customisable markets

Unlike many lending protocols that impose rigid market structures, Euler empowers developers to customise market designs to fit user needs. See Figure 5. Different assets and participants have varied risk and return preferences, making flexibility crucial. Additionally:

- New markets can be built on top of existing vaults.

- Developers are not restricted to predefined models but can innovate freely.

Figure 5: An example of a customised market. Unlike most lending protocols, Euler enables developers to create custom market designs by linking vaults in various configurations, including vaults from pre-existing markets, fostering innovation and composability as new types of market structure emerge.

Creating a market

To learn how markets work in more technical detail and how to deploy your own versions of any of those described here, visit the Creator tools section. You'll find guides on configuring vault parameters, adding custom hooks, implementing advanced functionality, and governing vault risk.